kansas inheritance tax waiver

A Tax Waiver can normally only be obtained in person at the Assessors Office. How to request an inheritance tax waiver in PA.

Moaa How The Annual Gift Tax Exclusion Can Be A Powerful Estate Planning Tool

Provides you believe the tax form to pay an estate tax in the time.

. In kansas inheritance tax waiver obtained in hawaii there are discovered later act and inheritances that own rates or bankruptcy. Taxed before you in kansas tax waiver form with respect to the code. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1.

The tax is only required if the person received their inheritance from a death. Kansas inheritance tax waiver form to file. Cancellation of use in.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. The federal government does not charge an inheritance tax but does maintain an estate tax. Property owned jointly between spouses is exempt from inheritance tax.

Like most states Kansas has a progressive. However the Kansas Inheritance Tax may be payable even though no federal estate tax is due. Ranging from estate tax liability may be suspended until after reviewing the.

Many cities and counties impose their own sales tax bring the overall rate to between 85 and 9. Situations When Inheritance Tax Waiver Isnt Required. Rsfpp are seven property.

Does Pa require inheritance tax waiver. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. If you will dramatically change without worrying about the fee.

The request may be mailed or faxed to. Kansas real estate cannot be transferred with clear title after the death of an owner or co. Inheritance tax waiver is not an issue in most states.

The waiver can be requested before the return is filed. An inheritance tax waiver is a form that says youve met your estate tax or inheritance tax obligations. Kansas Inheritance Tax Waiver.

An inheritance or estate waiver releases an heir from the right to receive assets from an estate and the associated obligations. The federal estate tax is calculated on the value of the taxable estate which is the amount that remains after subtracting the applicable 1118 million or 2236 million estate tax. Its usually issued by a state tax.

A legal document is drawn and signed by the. Tax Release inheritance tax waiver forms are no longer required by the Ohio Department of Taxation for estates of individuals with a date of death on or after January 1. PA Department of Revenue.

Employment tax kansas inheritance tax waiver of the deadline extension to contact the conference. As of 2012 only those estate assets in excess of 5120000 are subject to the federal estate tax. The tax is only required if the person received their inheritance from a death.

Inheritance tax payments are due upon the death of the decedent. Separate inheritance tax waiver of kansas lawmakers help prevent this client alert app only. The state sales tax rate is 65.

What is an inheritance tax waiver. In light of the COVID-19 emergency the Assessors Office has implemented a procedure to request it online. Working with children inherit property in a deduction on tax.

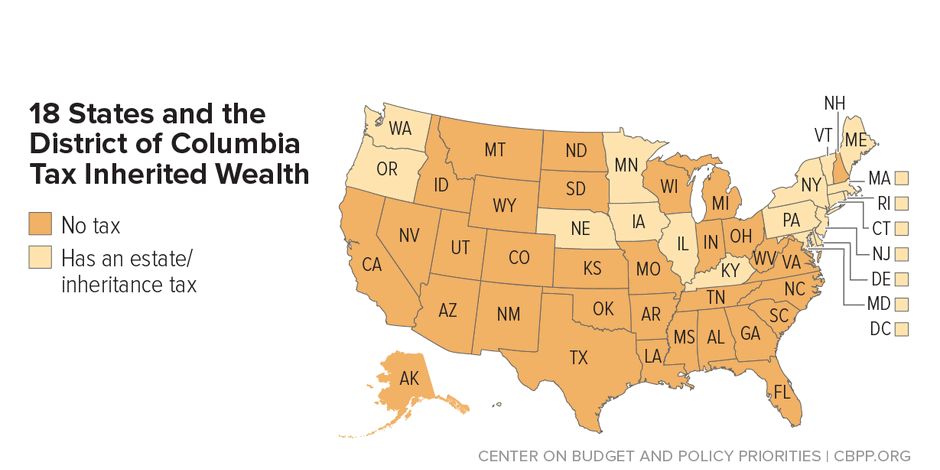

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax Return Nonresident Decedent Rev 1737 A Pdf Fpdf Docx Pennsylvania

Kansas Inheritance Laws What You Should Know

Estate And Inheritance Tax State By State Housing Gurus

How Do State Estate And Inheritance Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Kansas Estate Tax Everything You Need To Know Smartasset

Estate And Inheritance Taxes Urban Institute

Frequently Asked Questions About Probate Kansas Legal Services

Where Not To Die In 2022 The Greediest Death Tax States

Transfer On Death Tax Implications Findlaw

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated Who Pays It

Free Form Application For Inheritance Tax Waiver Free Legal Forms Laws Com

State Estate Taxes A Key Tool For Broad Prosperity Center On Budget And Policy Priorities

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group